Xiaomi's 5% Profit Cap Could've Drowned Investor Interest in Its IPO

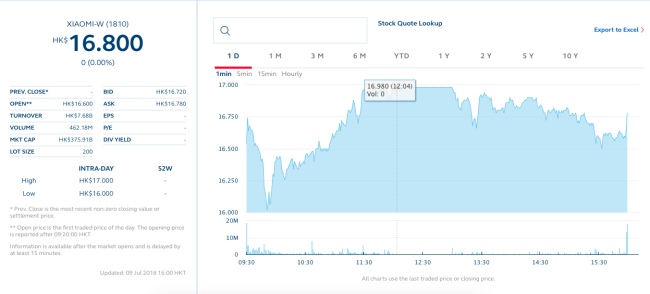

Putting an end to our apprehension, Xiaomi finally went public and the outset day of trading has now come to a close. The company would've expected a meliorate opening on the Hong Kong Stock Exchange simply it was without much fanfare as the stock opened at $HK16.60 when compared to the $HK17 offer price.

A Rocky Commencement

Yeah, Xiaomi's stock trading was off to a rocky commencement and share prices came tumbling downwardly to the lowest betoken of the day at $HK16 in the kickoff 30 minutes of its list. Xiaomi's stock price has since recovered but it still closed nether the IPO price at which shares were offered to investors or consumers.

The Chinese giant had offered 2.eighteen billion shares to its consumers in the HK$17 to HK$22 per share toll range. It later picked the lower-end of the price range for the list, which values Xiaomi at around $54 billion.

Prior to its $50 billion IPO, which is lower than the initially predictable $100 billion, Xiaomi CEO Lei Jun had taken the stage at the announced a certain policy that favored consumers and showed how deeply the phone maker cared most them. The company had capped its profit margins at 5 percent and decided to share any backlog money they make with their users in one style or another.

Profit Margin Cap Affects IPO?

This was a curious move, especially because it came only ahead of the IPO, and appears to have diluted the investor interest in Xiaomi. The folks over at Gadgets 360 were nowadays in Hong Kong for the official listing and have got an reply on whether the profit margin cap could've affected the IPO and lead to a lukewarm response from investors.

Xiaomi's Chief Financial Officer (CFO) Shou Zi Chew in a argument said, "I think the perspective to accept on this cap on hardware profits needs to exist a long-term one." He and so connected to add the turn a profit margin cap is not only a delivery from the direction of the electric current generation, but also people who volition take over the company in the next 30, 40, 50 years.

The company always boasts about its honest pricing when they launch a new product and Chew says that it isn't here to make that extra buck. The 5% margin cap was imposed to drive this point home, along with the fact that information technology is central for them to be friends with the fans of the company. To tiptop this off, Chew says that "the very showtime product that we had, MIUI, is a production that we congenital in collaboration with our users. Today, it remains the only Bone in the world that'due south updated on a weekly footing."

Finally, he says that the long-term goal of the visitor is to make amazing products and deliver the best experience to its users. There are many investors, along with consumers who picked upward their stock today, who understand the ideology and values of the company. So, the 5% turn a profit margin cap could have affected the IPO but it will become clear to their investors over the coming years.

Source: https://beebom.com/xiaomi-5-percent-cap-drowned-investor-interest/

Posted by: popewassend68.blogspot.com

0 Response to "Xiaomi's 5% Profit Cap Could've Drowned Investor Interest in Its IPO"

Post a Comment